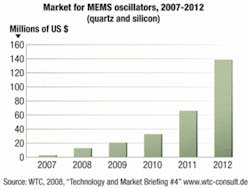

Market for MEMS oscillators will grow to $140 million by 2012

The market for microelectromechanical systems (MEMS)-based oscillators should grow from $2.5 million in 2007 to $140 million in 2012 as MEMS equivalents begin to displace quartz oscillators and crystals in more and more segments, say analysts at Wicht Technologie Consulting (WTC) in Munich, Germany.

This rate of growth is nearly 120 percent, WTC analysts say. After a few false starts, MEMS-based oscillators are finally beginning to leave the shelves in series. Already last year, close to 3 million MEMS oscillators shipped to end customers.

Three companies are delivering such devices. Discera and SiTime are manufacturing silicon MEMS oscillators, while Toyocom (part of Seiko Epson) produces micromachined quartz MEMS oscillators leveraging its so-called QMEMS process.

While quartz MEMS oscillators have started to replace incumbent quartz oscillators in the high-performance TCXO (Temperature Compensated Crystal Oscillators) function for mobile handsets and GPS devices, silicon MEMS oscillators today compete with quartz in the XO (crystal oscillator) function where the specifications for temperature stability are easier to meet. The first products to incorporate silicon MEMS oscillators are digital TVs and camcorders, as well as rear-view cameras used in automotive applications.

“We do not believe that silicon MEMS oscillators will have penetrated the $1 billion TCXO market by 2012,” says Jérémie Bouchaud, head of market research at WTC. “This is due to tough specifications relating to phase noise and temperature compensation. However, we do believe that the best opportunity for MEMS oscillators is with system-on-chip (SoC) solutions for the replacement of quartz crystals and phase lock loop (PLL) ICs.”

MEMS can make best use of the monolithic integration available with CMOS and the possibility to fabricate several resonators on one die to make SoC timing chips. This translates into fewer PLLs, better jitter performance and power consumption, and lower cost.

“The first products from Discera and SiTime can be described as system-in-package,” Bouchaud says. “However, silicon clocks have positioned themselves in SoC MEMS timing solutions from the start. The first commercial samples should be available within a year, with SiTime to follow. MEMS is not, however, the only technology enabling true SoC timing solutions. With the latest progress on silicon LC oscillator technologies, we believe companies like Mobius Microsystems are also planning single chip solutions to replace quartz crystal and phase lock loop ICs.”

For more information, visit WTC online at www.wtc-consult.com.