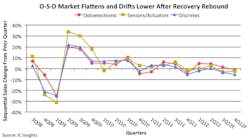

SCOTTSDALE, Ariz., 6 Nov. 2012. Quarterly growth in global sales of optoelectronics, sensors, actuators, and discrete semiconductors has slowed to nearly zero, and will post growth of only 2 percent in 2012, which is down from previous estimates, predict market researchers at IC Insights Inc. in Scottsdale, Ariz.

(story continues below)

Revenue growth in electronics manufacturing slowed to 3 percent in 2012, and sequential quarterly sales growth in electro-optics, sensors, actuators, and discrete semiconductors has continued to drift lower, analysts say.

The latest IC Insights forecast total electro-optics, sensors, actuators, and discrete semiconductors sales are expected to reach $58.2 billion in 2012 compared to the current annual peak of $57.4 billion set in 2011.

| Related stories -- Power is paramount -- Electronics miniaturization -- Inertial measurement units from Northrop Grumman to supply Eurofighter Typhoon Tranche 3A. |

electro-optics is propping up overall electro-optics, sensors, actuators, and discrete semiconductors sales growth, as revenues for electro-optics are forecast to rise by 8 percent to reach a new record high of $27.5 billion in 2012.

Driving electro-optics sales growth are lamp devices and CMOS image sensors in digital cameras for smartphones, tablet computers, surveillance networks, and other equipment, analysts say.

Sales of sensors and actuator should rise by just 2 percent in this year, yet will be a record high of $8.7 billion, while the commodity-filled discretes segment should fall 6 percent to $22 billion, analysts say.

When the three electro-optics, sensors, actuators, and discrete semiconductors segments are combined with IC sales, the total semiconductor market should be $317.6 billion in 2012, a 1 percent decline from 2011.

For more information contact IC Insights online at www.icinsights.com.