by John McHale

After seeing telecommunications applications take a nosedive during the last couple of years, designers in this once-thriving business are diversifying toward military end-users, who represent much more steady prospects than their traditional markets.

When economic times are tough it helps to be employed in the military marketplace whether one is a reporter or a design engineer — especially during a war with no sure end in sight.

Therefore companies that made loads of cash during the telecommunications boom just a couple of years ago and lost nearly as much when the boom tanked see many opportunities in military programs for their technology as well as in emerging homeland security applications.

Military applications are close to recession proof because of the hostile world in which we live, and are likely to remain stable for the foreseeable future, says Rod Woodward, industry analyst for telecom services at Frost & Sullivan in San Antonio, Texas.

What telecom and military providers have in common is system integration expertise, Woodward says. Both have to meet high-reliability and ruggedization requirements, he adds.

A sense of urgency from Gulf War II, the War on Terror, and the homeland security situation has encouraged many companies that do not traditionally supply the national security applications to give the military a try, Woodward says.

"Telecom is driven by the economy," Woodward says. Therefore when the economy slows, companies look for more business from vertical markets such as the military, homeland security, and medical, he explains. Instead of just having two or three sales people covering the military territory, companies now have entire departments and divisions dedicated to supplying applications such as these.

The reelection of the Bush administration also would bode well for the military market Woodward says. The administration supports a strong military and embraces technology, he adds.

More telecom companies are tailoring their products for homeland security, however these applications are slow to get started because the U.S. Department of Homeland Security is only a year old, and funding for technology is still filtering out slowly, Woodward says.

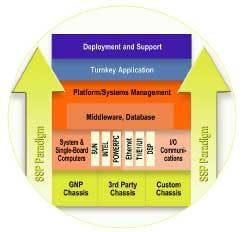

The telecom business has been very bumpy of late "but we see opportunities in markets such as the military and homeland security," says Brett Martin, director of system integration and business development at GNP in Monrovia, Calif. "Both require redundancy, high availability, and fault tolerance just like telecom. A minimum of two of everything is necessary, not unlike a flight-control system."

For instance telecom designers need to meet Network Equipment Building Standard (NEBS) level III, which measures how well equipment could survive an earthquake that measures 8.1 on the Richter scale, Martin says. This is similar to the military's drop test, he adds.

Homeland Security is a little easier to enter, Martin says. GNP also has developed a data-communications network for video security for homeland security applications, Martin says.

The military is a different animal, Martin says. Being a military supplier is a great place to be once established, but getting in is a challenge, Martin says. It is an articulation challenge, he adds.

Working with the military requires a strong knowledge of military standards and of the procurement methods the U.S. Department of Defense (DOD) uses, Martin says. To do that a company must partner with a relatively large provider, such as prime contractors Lockheed Martin or Northrop Grumman.

The DOD's commercial-off-the-shelf (COTS) initiative from 10 years ago has made it much easier for commercial companies like GNP to get into DOD programs, but they still need a "translator" to help them understand the intricacies of the DOD procurement process, Martin says.

GNP has partnered with a major defense prime contractor, but Martin declined to comment further on the contract.

GNP offers a voice- and data-enabled platform for enhanced services, merging telecom mobility, and the Internet. GNP is an outsourcing system integrator whose leaders do not even put the company name on any systems in which they are involved. "We do the work and put our customer's label on the hardware," Martin explains.

Typical configurations include a voice-processing card in GNP Compact PCI chassis, Sun Microsystems computers for data and voice/data correlation programs and other telecom applications that require a computer, and Cisco Systems for networking elements — all integrated and certified as NEBS level III for the telecom central office, NP officials say.

For more information on GNP go to www.gnp.com.

Fiber lasers

Engineers at NP Photonics in Tucson, Ariz., started out developing their technology for telecom applications but today are finding business starting to come from military applications such as light detection and ranging (LIDAR) and laser radar (LADAR).

In fact the majority of NP Photonics business is now military-related, says Phillip Vark, vice president of sales and marketing at NP Photonics. The company's fiber lasers are long coherent single-frequency lasers that are more efficient than traditional diode lasers because they consume relatively little power.

NP Photonics has an ultra-narrow line width, high-power fiber laser for several applications called the Scorpion EMF Fiber Laser SMPF-2030. The device is designed for sensing, LIDAR, test and measurement, and telecommunication applications.

The company's Erbium Micro Fiber (EMF) laser incorporates proprietary EMF technology developed at NP Photonics. A telecom-grade T/E cooled single-mode diode laser pumps the erbium-doped microfiber. The laser provides as much as 200 milliwatts of output power with a center wavelength anywhere in the C-band (1530-1563 nanometers).

NP Photonics was also awarded a Phase II Small Business Innovation Research (SBIR) contract by the U.S. Missile Defense Agency (MDA) in Arlington, Va. The MDA SBIR contract will support further development of the NP Photonics multimode-pumped, monolithic gain array. This compact device has the potential to provide low-cost amplification throughout a variety of optical communication and fiber-optic sensing networks, NP Photonics officials say.

"The SBIR program is quite competitive, so it's an honor for us to have been awarded this Phase II contract," says Chuck Chandler, chief executive officer of NP Photonics. "This is a result of a lot of hard work by our development team. They've created a unique gain array that combines the high-performance features of standard erbium-doped fiber amplifiers with the compact size and ease of integration of semiconductor-based amplifiers."

In Phase I of the MDA SBIR Program, NP Photonics developed a low-cost fiber drawing method using erbium-doped phosphate glass to produce the gain array, NP Photonics officials say. The company then successfully built and tested the multimode-pumped, monolithic gain array. In Phase II, NP Photonics engineers will continue investigating the concept and will develop a verified prototype.

NP Photonics engineers have developed a broad family of products based on the company's EMF and compliant microelectromechanical systems (MEMS) technology, including tunable filters, optical spectrum analyzer engines, fiber lasers, ASE sources, and fiber amplifiers.

For more information on NP Photonics contact the company on the Web at www.npphotonics.com.

Perimeter security

A longtime supplier of fiber optics, Fiber Instrument Sales (FIS) in Oriskany, N.Y., has found a unique way of applying their fiber-optic technology to perimeter security with their Fiber Fence product. One of their current customers is the U.S. Air Force, which uses it to protect its jet fuel depot at the Pease Air National Guard Base in Newington, N.H.

The company has long sold to the military from their optical connector product line that is available off the shelf for telecom and military applications. This diversification also enabled them to weather the economic downturn more successfully than other companies, officials say.

The Fiber Fence turns a fence into a giant sensor that can warn security personnel immediately of any breach, pinpoint the location, and even direct remote cameras and other sensors. In its simplest form, the Fiber Fence is a one, two, or three 900-micron strand of fiber-optic cable. When an intruder bends or breaks it, an alarm sounds, explains Greg Bowie, director of security for FIS.

The Mouse Trip can be set to trip at as little as five ounces of pressure or as much as two pounds to minimize nuisance alarms due to wind or blown debris. It simulates a break in the fence and triggers the alarm. Software shows where the break is happening so security personnel can dispatch human guards or bring a pan-tilt zoom camera to bear.

Fiber Fence technology is very flexible and can even be attached to traditional chain link fences, which saves a lot of money, Bowie says.

FIS began selling the product after the terrorist attacks of Sept. 11, but developed it some time before that, Bowie says. Now FIS has entire department dedicated to security applications.

FIS also recently landed a contract with Toyota to secure the perimeter of one their plants. Bowie says the company is also exploring more opportunities with the military, but that can be a slow process.

Mostly it is a matter of funding or lack of funding, says Charles Carino, director of marketing at FIS. "Once they get the money it's used for something else — it's a process of taking two steps forward and one step back." However, if one has patience and hangs in there the military customers will appreciate that and "work with you," Carino says.

FIS is also looking to work with an Army Small Business Innovative Research (SBIR) program to apply their Fiber Fence technology to other applications, Bowie says. Company engineers are already working with a company to use the Fiber Fence concept on a railroad bridge to measure stress, he adds.

For more information on the Fiber Fence and FIS go online to www.fiberinstrumentsales.com.

Single-board computers

Manufacturers of the Compact PCI single-board computer architecture, who aimed originally at telecom applications, now are finding new military applications for their products.

Military designers have traditionally used the VME architecture and will continue to do so with upgrades, but in new designs some integrators are turning toward Compact PCI for use in communication applications, says Joe Pavlat, president and chairman of the PCI Industrial Manufacturers Group (PICMG) in Wakefield, Mass.

One of the reasons behind this is the move from parallel buses to serial buses, which enables faster communications between boards, Pavlat says. The latest Compact PCI standard PICMG 2.16 addresses this with Ethernet as the switched serial connection, Pavlat says. Ethernet is used in 90 percent of networks, he says.

The VME International Trade Association in Fountain Hills, Ariz., also has a switched interconnect standard for VME — VITA 41; if there is any VME product addressing Ethernet as a switched fabric it is few in number, Pavlat says.

Two examples of companies that already have 2.16 6U form-factor products available are CG Mupac in Brockton, Mass., and Diversified Technologies in Ridgeland, Miss., Pavlat says.

The most common form factor of Compact PCI among military designers right now is 3U. Companies that produce these boards include SBS Technologies in Albuquerque, N.M., Dy 4 in Kanata, Ontario, MEN Micro Inc. of Carrollton, Texas, and PEP Modular Computers in Pittsburgh.

More and more military designers and companies are joining PICMG because of the extra horsepower provided by PICMG 2.16, Pavlat says.

For more information on PICMG go online at www.picmg.com.

Enea's RTOS finds use in telecommunications and military communications

Engineers at Enea Embedded Technology in San Diego mostly design their real-time operating system (RTOS) — Enea OSE — for telecommunications applications, but have found that it would have a place in military applications as well.

The technology on its own can work in either military or telecom — depending on the applications. Military program managers may be sensitive to using Enea products because the company is Swedish owned, says Mike Christofferson, product marketing manager at Enea.

The OSE RTOS targets high-availability and distributed-processing applications, Christofferson says.

OSE is essentially a message-passing operating system, which makes it appropriate for high-throughput systems, Christofferson continues. It is tailored to deliver messages from one application to another within the system.

Message passing is not something popular military RTOSs such as Integrity from Green Hills Software in Santa Barbara, Calif., and Vx Works from Wind River Systems in Alameda, Calif., are designed from the ground-up to do, Christofferson claims. They are excellent systems for what they are designed for, but OSE is kind of a specialist at this technique, which is why it so widely used in telecom applications, he continues.

OSE is safety critical because it complies with the FAA's DO-178B requirements for flight safety; it is fault tolerant, and is available off-the-shelf, Christofferson says. "Telecom blazed the trail for fault-tolerant applications," he adds.

Enea guarantees that any faults in the OSE system will be isolated in a central location and dealt with so they do not affect other applications in the system, Christofferson claims.

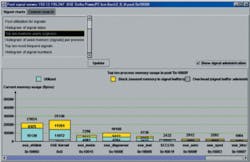

Enea also offers the OSE Illuminator, a suite of software tools for application-level debugging and analysis of embedded applications. OSE Illuminator integrates useful plug-ins to provide debugging and system information with a graphical, user-friendly interface. IT is designed for debugging distributed multi-CPU systems as well as single CPU systems, company officials say.

Application-level debugging is performed at a higher abstraction level than source code debugging, allowing the user to debug based on the events of the application, such as messages sent between processes and context switches, Enea officials say. The user can also view how the application is using system resources such as memory and CPU time.

For more information on Enea and the OSE RTOS contact the company online at www.enea.com.—J.M.

DTI introduces new PICMG 2.16 blade for military and communications networks

Officials at Diversified Technology Inc. (DTI) in Ridgeland, Miss., recently released their cPB-4610 Pentium Compact PCI Blade expanding its line of PICMG 2.16 products targeted at original equipment manufacturers developing products for commercial and military networks.

The cPB-4610 complies with the PICMG 2.16 standard and optimizes system bandwidth featuring a 400 MHz Front Side Bus (FSB) for use in packet-switched backplane platforms, company officials say.

"With its single-slot form factor and the ruggedized/conduction cooled options, the cBP-4610 delivers a space-saving, durable solution for multiple environments," says Mike Dempsey, DTI's chief technology officer. "Intel's Pentium M processor offers the performance required for intense, real-time computing and eliminates thermal risks associated with high-power, space- limited footprints."

The cPB-4610 comes with a low-power Intel Pentium M processor, and can be used only as a system master processor blade in a 2.16-compliant packet-switched-backplane (PSB) environment, DTI officials say.

Three levels of ruggedization are available on the cPB-4610 processor blade including "industrial (0 to 55 degrees Celsius/12g shock), "rugged" (0 to 55 degrees C/20g shock) and rugged conduction cooled (–40/55 to 85 degrees C without airflow/100g shock).

As part of DTI's PlexSys family of PSB products, the cPB-4610 processor blade is validated with DTI's cPS-4081 4U general purpose, carrier grade computing platform with cSB-4220 Ethernet level 2/3 switch, company officials say. Also included is ATA/100 application software for shorter boot times and faster I/O rates, and a programmable two-stage watchdog timer for enhanced system reliability and a two-year limited warranty.

The cPB-4610 system/peripheral processor blade is a cost-effective choice for application developers addressing high-performance, converging Telecom and Internet IP-based applications such as VPN switchers, media gateways, 2.5G/3G wireless, server clusters, IP DSLAM, and voice/video/data servers, DTI officials claim. The additional ruggedization and conduction-cooled options support commercial-off-the-shelf requirements for hardened solutions.

For more information on DTI go online at www.dtims.com.