Editor in Chief

Industry consolidation in the printed circuit board business is creating what looks suspiciously like a new breed of major defense-systems integrators. I don’t know if we can call them prime contractors yet, but stay tuned; that could change.

For the moment, I’ll call them major embedded systems integrators.

The latest development happened March 20 when officials of GE Fanuc Embedded Systems acquired SBS Technologies of Albuquerque, N.M., creating a diversified company with its roots in the board business.

With the SBS acquisition, GE Fanuc is taking its place among first-tier defense-systems integrators that a decade or more ago included companies such as Control Data, Sperry, TRW, and E-Systems, and today consist of GE Fanuc and Curtiss-Wright Controls.

Those old names are gone now-vacuumed up in previous waves of industry consolidation by prime contractors like General Dynamics, Northrop Grumman, and Raytheon-but they played an important role in their day supplying custom-designed finished systems and subsystems to the primes.

Over the past decade, as the defense industry adapted to the new paradigm of commercial-off-the-shelf (COTS) components and subsystems, the suppliers that took the place of the old first-tier systems integrators often were open-systems board suppliers such as Dy 4 Systems, Vista Controls, Computer Dynamics, and SBS.

These relatively small companies could move quickly to supply prime contractors with the kinds of embedded systems they needed for new military platforms and systems upgrades, which met the U.S. Defense Department’s mandate to use COTS components unless the only solutions available were custom designs or proprietary technology.

That worked for a while, but it didn’t give the prime contractors what they craved most in a rapidly changing world of embedded technology-stability.

In the old days, the prime contractors knew that Sperry, Control Data, and E-Systems were unlikely to go out of business anytime soon, and were positioned as reliable, stable, predictable partners on complicated military, space, and commercial aviation projects.

Today, GE Fanuc and Curtiss-Wright have that same cachet. The primes know those two companies are in the game for the long haul, and provide reliable, stable, predictable partners in the brave new world of COTS technology and open systems.

The latest wave of industry consolidation that led to creation of these two embedded systems behemoths coincidentally started right around the time of the terror attacks on the World Trade Center towers and the Pentagon back in late 2001.

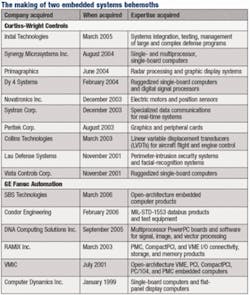

GE Fanuc had acquired Computer Dynamics Inc. in January 1999, buying with it the Computer Dynamics expertise in single-board computers and flat-panel displays. By July 2001 GE Fanuc leaders announced another acquisition-VMIC and that company’s expertise in open-architecture VME, PCI, CompactPCI, PC/104, and PMC embedded computers.

The race was on.

In a bid to keep pace in the competition to become the next major embedded systems integrator, Curtiss-Wright Controls acquired Vista Controls Corp. and Lau Defense Systems in November 2001, bringing into the parent company technological experience in ruggedized single-board computers, perimeter-intrusion security systems, and sophisticated facial-recognition systems-all just in time for ramp-up in homeland security applications following the 9/11 attacks.

The next round was in March 2003, when GE Fanuc acquired RAMiX Inc. and its experience in PMC, CompactPCI, and VME I/O connectivity, storage, and memory products. That same month, Curtiss-Wright acquired Collins Technologies and its expertise in linear variable displacement transducers (LVDTs) for aircraft and flight control.

At this time Curtiss-Wright kicked its growth initiative into high gear by acquiring Peritek Corp and its line of graphics and peripheral cards in August 2003; Systran Corp and its specialized data communications boards for real-time systems in December 2003; and that same month by acquiring Novatronics Inc. with its electric motors and position sensors.

GE Fanuc growth remained relatively dormant in 2004, as Curtiss-Wright acquired Dy 4 Systems and its line of ruggedized single-board computers and digital signal processors in February 2004; Primagraphics and its radar processing and graphic display systems in June 2004; and Synergy Microsystems and its line of single- and multiprocessor single-board computers in August 2004.

Curtiss-Wright added another company to its portfolio in March 2005 with its acquisition of Indal Technologies and its expertise in systems integration, testing, and management of large and complex defense programs.

While Curtiss-Wright leaders were recovering from their dizzying string of acquisitions, GE Fanuc was re-emerging as a growing defense electronics company to be reckoned with.

In September 2005 GE Fanuc acquired DNA Computing Solutions and its multiprocessor PowerPC boards and software for signal, image, and vector processing. Just a few months later, in February 2006, GE Fanuc pulled the trigger again with its acquisition of Condor Engineering, a recognized industry leader in MIL-STD-1553 avionics databus technology and test equipment.

GE Fanuc capped its latest string of acquisitions with its successful bid for SBS last March, and with it a notable line of open-architecture embedded computer products. At press time everything looks quiet, but probably not for long. I wouldn’t be surprised to see another round of acquisitions by GE Fanuc, Curtiss-Wright, or both, perhaps within the next few months. We may also see some acquisition movement in other embedded industry forces, such as the United Kingdom-based Radstone Technology.

Rapid industry consolidation and the creation of giant competitors in the embedded systems market tends to make the smaller companies nervous. Their leaders often wonder whether to survive they must move quickly either to acquire other companies or be acquired themselves.

Veteran industry watcher Joe Pavlat says the smaller board companies have little to worry about-as long as they work to their strengths and don’t try to compete head-to-head with the big boys.

“This should not scare the small guys. It reinforces the business model of the little guys, who have to be different from the big guys,” says Pavlat, who is president of the PCI Industrial Computer Manufacturers Group (PICMG) in Wakefield, Mass.

“The little guy can move quickly and do custom work, and the big guys might not be as efficient in engineering and manufacturing,” Pavlat says. “The big guys go after the big contracts that would never be available to the small guys. The model for the small guys is you have to go after the small to medium applications where your nimbleness and ability to do custom engineering is an advantage.”