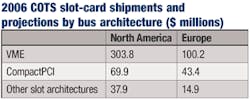

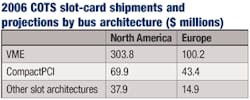

The market for commercial-off-the-shelf (COTS) VME slot cards reached $408.7 million in 2005 for the North American and European markets combined, according to analysts at Venture Development Corp. (VDC) in Natick, Mass.

This compares to $354.1 million, which was forecast for 2005 in the second edition of VDC’s market demand analysis released in 2004 and based on year 2003 data. This represents 5.9 percent of additional dollar volume of VME slot card shipments to North America for military and aerospace applications, compared to the projections made for 2005 from the 2003 data.

The European market experienced an increase of 37.4 percent of additional dollar volume shipments from the projections made from 2003 data. The North American and European markets combined increased 15.4 percent over the previous projections for 2005.

There are two primary reasons for the larger-than-projected 2005 shipments of COTS VME slot cards, according to VDC analysts.

First, military budgets have been increasing since 2003. This is especially true in developing European nations and the United States, which accounts for 47 percent of worldwide spending on defense.

The continued wars in Iraq and Afghanistan have not only been a major factor in forcing increased defense spending, but they have also prolonged the implementation of VME slot cards in some military systems.

Many systems may be switching to a newer architecture such as CompactPCI or down the road ATCA. However, the upgrades away from VME are delayed until the conflicts are over because the militaries are weary of making changes/upgrades to equipment that is being used routinely in battle situations.

The second reason is the continuing versatility of VME technology, which continues to reinvent itself, VDC analysts say. The current development of the VXS (VITA 41) and VPX (VITA 46) standards for switch-fabric implementation make the architecture much more competitive from a technology standpoint, which makes an upgrade to CompactPCI or other architecture less attractive because the advantages over VME are less.

This is not to say that the VME architecture is completely safe from competing architectures and the inroads these architectures are making into the COTS market and military and aerospace applications, which in the past has been predominately a VME market.

CompactPCI, in particular, poses a large risk for VME as many military applications are using CompactPCI, especially new projects.

VME is projected to be the slowest growing architecture as the others make major inroads into the military embedded COTS market. The category “Other Architectures” includes PCI, ATCA, ISA, PCI-ISA, and other legacy architectures and has a large CAGR largely due to projected demand for ATCA and MicroTCA (although these are highly speculative in the MIL COTS market).

For more information contact VDC online at www.vdc-corp.com.