Market in transition: North American ATM equipment revenues to drop over next decade

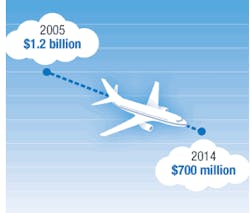

Revenues from North American sales of air-traffic management equipment are expected to drop by 46.7 percent during the decade from 2005 to 2014, according to analysts at market researcher Frost & Sullivan in London.

Revenue from air-traffic management equipment (ATM), such as satellite navigation, digital communications, and digital datalinks, and Automatic Dependent Surveillance-Broadcast (ADS-B), will drop from $1.2 billion in 2005 to $700 million in 2014, according to Frost & Sullivan analysts.

Primarily driving the ATM market during this period will be satellite navigation, digital communications and datalinks, and ADS-B, analysts say.

The adoption of revolutionary ATM concepts will primarily drive growth in the North American ATM markets, analysts say in a report entitled “North American Markets for Air Traffic Management Systems 2005-2014.”

Although the markets are unlikely to sustain their growth momentum until 2014, their substantial value and revenue potential will attract new participants, including nonregional vendors, despite the significant entry barriers.

“The North American aviation industry is finally recovering following the events of 9/11,” notes Frost & Sullivan Consulting Analyst Georgios Oikonomakis. “During the next ten years, North America will witness the realization of innovative ATM concepts such as satellite navigation and ADS-B that are transforming civil aviation as well as the dynamics of the ATM markets.”

North American countries have been among the earliest adopters of digital air-ground communications, satellite navigation based on GPS and ADS-B. Such initiatives will drive revenues in the communications navigation and surveillance segments in the future.

Although regional competitors still dominate the North American ATM markets due to historic contract allocations, reduced funding capabilities and the ATM’s program-driven, cyclic nature will make it difficult for the market to achieve a sustainable growth rate, Frost & Sullivan analysts warn.

“In this competitive environment with its significant entry barriers, product differentiation will be highly irrelevant,” Oikonomakis says. “Instead, the way to secure contracts will be through partnerships with North American industry giants that will remain preferred suppliers and prime integrators in the region until 2014.”

Early participation in ATM projects will be a key success factor in the region, with 90 percent of anticipated revenues expected to derive from U.S. Federal Aviation Administration (FAA) programs, analysts say.

To receive a virtual brochure that provides manufacturers, end users, and other industry participants with an overview of the analysis of the North American Markets for Air Traffic Management Systems 2005-2014, send an e-mail to Srividhya Parthasarathy in corporate communications at Frost & Sullivan at [email protected] with full name, company name, title, telephone number, e-mail address, city, state, and country.

For more information on this report, contact Frost & Sullivan online at www.aerospace.frost.com.