Flight management system market growing, predicted to reach $912 million by 2020

DALLAS, 14 July 2015. The global market for flight management systems (FMS) will reach $912.20 million by 2020, growing at a compound annual growth rate (CAGR) of 7.19 percent, from $601.36 million in 2014, predict analysts at marketsandmarkets.

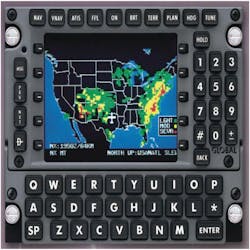

Flight management systems can be classified into four segments according to the cockpit architecture of different types of commercial aircraft, including very large aircraft, wide body aircraft, narrow body aircraft, and regional transport aircraft. All these aircraft are equipped with two flight management systems that perform the ideal functions. The average cost of a flight management system differs according to the functional and performance parameters required by different aircraft. The FMS market in a particular region depends upon the number of aircraft deliveries in the said area, as well as the aircraft maintenance activities in that particular region.

The latest marketsandmarkets report -- "Flight Management System Market by Cockpit Architecture (VLA, WB, NB, and RTA), Hardware (FMC, CDU, and VDU), Maintenance (Line-fit and Retrofit) & by Geography (North America, Asia-Pacific, the Middle East, and Europe) - Forecast Analysis to 2014 – 2020" – indicates that Asia-Pacific had the largest market with 36.76%, followed by Europe with 23.86%, and North America with 19.92% in 2013.

Despite the slow global economic growth and increase in aircraft fuel cost, the demand for new aircraft deliveries will swell and the demand for flight management systems will intensify, being a subset of an aircraft.

Advanced flight management systems perform a wide variety of tasks right from providing an accurate flight plan for a smooth flight operation to efficient aircraft fuel utilization. These are some functional capabilities of FMS that are expected to fuel its growing market demand in the near future.

The development of new and advanced flight management systems has meant that almost every aircraft can now be modified to improve its operational efficiency for better flight operations.

In challenging economic times, airlines are constantly looking at ways in which they can add value and extend the life span of their aircraft. Up gradation of aircraft with efficient flight management systems provide it with the ability to fly more fuel efficiently, such as using Required Navigation Performance (RNP) and continuous descent that can translate into measurable fuel and time savings for airlines, along with reduced pilot workload and enhanced safety.

The retrofit market of flight management systems for wide body aircraft is estimated to grow at a CAGR of 9.96% from 2014 to 2020, according to marketsandmarkets analysts. The growing demand for aircraft deliveries and continuous increasing passenger traffic across the world is the prime region for this growth. However, there are many challenges involved in equipping new flight management systems in the cockpit of an aircraft, such as the presence of a long development life cycle from equipment design to certification of FMS, and the need for well-developed testing and certification programs. The retrofit FMS designs need to follow the same rigor as the originally developed systems on the aircraft. Also, its proper integration must take into account all of the constraints and dependencies while interfacing with existing equipment.

The flight management systems market for narrow body aircraft is estimated to grow at a CAGR of 7.18% from 2014 to2020. The Asia-Pacific region is projected to dominate the FMS market in this category; it holds the maximum share of the flight management system for wide body aircraft, but the Middle East is the fastest growing region in this segment.

The rapidly increasing passenger traffic rate across the world will require safety operations of the fleets that operate in this region. The NextGen FMS is capable of adhering to those safety needs by automating flight operations that include flight plan and fuel management that are very necessary for the regional transport aircraft. These factors will raise the market growth of FMS in this segment.

The report contains profiles of leading players involved in this market, such as Honeywell, Thales SA, GE Aviation, Rockwell Collins, and Jeppesen. The report takes into account a wide range of factors and its influence on the market dynamics. Increasing investments in R&D, coupled with an information flow for requirement analysis will help the market move at a steady pace.