A case for airports: management confronts challenges

Kroll Bond Rating Agency (KBRA) has reviewed the current state of play of ratings for U.S. publicly owned airports, which we believe to be an underrated sector. This sector has experienced no defaults, and airport management, which KBRA believes is underemphasized by others, has performed a critical role in confronting the challenges this sector has faced over a prolonged period.

Airport sector ratings overview

As discussed in KBRA’s U.S. General Airport Revenue Bond Rating Methodology, U.S. airports are typically financed through the issuance of revenue bonds. That is, the underlying security is a stream of revenues derived from airline payments and non-airline sources, as opposed to general obligation bonds, which are backed by a municipality’s ability and willingness to levy property taxes for debt repayment. Landing fees, airline terminal related charges, parking fees, concession fees, and leases provide the revenue stream supporting general airport revenue bonds (GARBs).

Credit ratings are opinions of relative creditworthiness expressed using an easy to understand symbol system. Creditworthiness is a characteristic of borrowing entities or transactions and is itself unobservable. What we can observe is whether or not issuers within a sector and rating category default with the same frequency as issuers in other sectors with the same rating. Rating methodologies are designed to guide the assignment of ratings so that credit risk equates, at each rating level, across all sectors, geographies and time.

Over time, it may become apparent that a particular sector is under- or over-rated. Typically, this would be manifested by significant deviations in default experience relative to assigned ratings. However, the incidences of default can be volatile, typically driven by macroeconomic and/or exogenous shocks. In public finance, we believe the incidence of defaults to be idiosyncratic. As we show below, the record for rated, publicly-owned U.S. airports is quite clear.

Airport sector performance and history

U.S. publicly-owned airport ratings from S&P and Moody’s range from a high of AA/Aa2 to a low of BBB-/ Baa3, as shown in the following frequency distribution. As can be seen, the modal (or most frequent) rating is A+ and the median rating is A. (For this chart, we selected the higher rating for airports with split ratings.) We plot a time series of average U.S. airport GARB ratings in the chart below. Over the past ten years, the

U.S. publicly-owned airport sector has, on average, trended around the A range. It started the period in the A range, strengthened, but more recently has moved closer to an A- rating. Although the sector’s average ratings level increased following the turmoil of the September 2001 terrorist attacks, it began to slip with the onset of the financial crisis.

No defaults

KBRA has published several widely cited default studies for the U.S. municipal bond sector, which includes U.S. airports1. Our data spans more than a century of default activity and we have found that there have been no defaults of U.S. publicly-owned airport GARBs2.

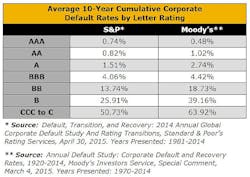

This raises the following question: Is the default record consistent with the ratings assigned to this sector? Based on the average 10-year cumulative corporate default data published by S&P and Moody’s, issuers rated in the A category tend to default, on average, at a rate of roughly 2.1%3 over a ten-year horizon (see table below). For BBB category issuers, the figure is 4.2%3.

That is, on average, two out of 100 issuers rated in the A category have historically defaulted over any ten-year period, with twice that amount defaulting among issuers in the BBB category. The fact that there have been no rated U.S. airport GARB defaults suggests this sector may be underrated. The calibration of ratings across sectors, while challenging to achieve in practice, is nevertheless aspirational, and one of the key functions of a full-service credit rating agency. Otherwise, one would expect to see a plethora of small, industry specialized agencies.

Management essential to airport credit quality

Airlines and airports are subject to distinct forces that determine credit standing. Despite changes in airline business models from a market share focus to one of maximizing profits, airline financial operations continue to be pressured by the need to compete for passengers, manage commodity price volatility, and control labor costs. The airline industry has gone through an upheaval commencing with the Airline Deregulation Act of 1978 and its attendant restructuring, followed by multiple recessions, the September 2001 terrorist attacks, pandemics and tsunamis, fuel price spikes, the 2008 – 2009 financial crisis and the current slow economic recovery.

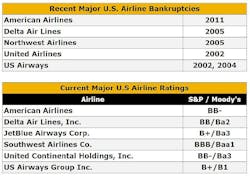

Following deregulation, the airline industry has gone through boom and bust cycles, and more than 150 airlines have entered various stages of bankruptcy, or gone out of business. Despite recent record profitability, major U.S. airline ratings, as shown above, are generally rated below investment grade by other rating agencies.

Competition among airports is limited within a particular market, given the costs of entry, land availability, and environmental issues associated with siting a new facility. Airports are critical to the national transportation system, and most function under a cost recovery business model that promotes financial health, even during economic downturns. However, individual airports are vulnerable to airline scheduling decisions, and have in many instances been adversely affected by the closure of hubs and the consolidation that has overtaken the airline industry.

While airport ratings are significantly higher than major airline ratings, KBRA believes that ratings assigned to airports by other ratings agencies are somewhat depressed by their connection to servicing airlines.

Although KBRA shares some of these concerns, in our view, consideration of airport management is a crucial missing component in many airport analyses. KBRA believes that airport management represents a critical factor in confronting the day-to-day challenges that airports face. In KBRA’s opinion, a favorable assessment of management may result in a higher rating than would otherwise be assigned. For additional information, please see KBRA’s special report “Why Effective Airport Management is Essential”, dated February 5, 2015.

Summary

KBRA believes that the U.S. publicly-owned airport sector is underrated by other rating agencies based on the incidence of default, the ability to weather idiosyncratic shocks over a long period of time, and the role of management, which has successfully navigated through a succession of turbulent periods.

KBRA acknowledges the assistance provided by Josh Deligdish and Nick Rizzo, who were instrumental in the preparation of this report.