COTS in space: procurement strategy

By Dan Friedlander

Retired following 44 years in component engineering

The procurement of electrical, electronic, and electromechanical (EEE) components phase is common for all applications (commercial, automotive, military, space, etc.). Nevertheless, every application type has its own characteristics.

For the majority of cases, the term “procurement” is associated with a mainly logistics process, including phases of negotiations, ordering, order status monitoring, supply chain assurance, delivery of components to be used as is. Often, the procurement staff efficiency is measured in terms of money. Such a mindset of money prioritization may result in quality and reliability compromises.

The procurement of EEE components for space applications is a more complex process than the above-mentioned one. In addition to more complex logistics (activities performed in different locations), the process includes component engineering, test engineering, electrical/environmental testing, radiation testing, and specification writing.

The moneywise issues’ importance is still an important factor, together withquality/reliability assurance.

In fact, the procurement process is an extended three-tier process: pre-procurement, procurement, and post-procurement. This extended process outputs the ready-to-be-flown EEE components.

There are different practiced procurement strategies and methods, tailored to the EEE components buyers’ needs.

The main parameters for selecting the applicable strategy are and not limited to:

- outsourcing decisions

- components buyer status: prime contractor, subcontractor

- contractual requirements

- parts control plan requirements

- cost effectiveness

- applicable in-house infrastructure extent

- experience accumulation

This article is mainly based on my component engineering experience in the domain of military and space applications. The experience is not confined to the use of MIL/space EEE components, but also to extensive and successful use of commercial off-the-shelf (COTS) components.

Characteristics of EEE component procurement process for space applications

The EEE components procurement process for space applications is a complex multidisciplinary activity. The factors complicating the process are:

- Need for specialized, knowledgeable components engineering, capable to lead the engineering aspect of the to be procured components. The component engineering, in fact, is responsible to all the activities related to components, as required in the pre-procurement phase, procurement phase and post procurement phase, as required in the development and manufacturing of the different projects. As prime contractor, the components related activities encompass also the applicable activities for all the relevant subsystems developed and manufactured by subcontractors (domestic and abroad).

- Aside from the usual logistic activities, the procurement process for space is complicated by unique environment related requirements (radiation, microgravity, vacuum, outgassing, etc.).

- Satellites being not maintainable systems, require special quality/reliability attention.

That leads to the fact that procured EEE components from component manufacturers are often not used as is. - To address the above mentioned special requirements, additional disciplines are involved in the process: radiation, testing engineering, special logistics, etc.

- Use of COTS in satellites further complicates the process of reaching the final goal of obtaining satisfactory flight components.

EEE components procurement strategy for space applications

In general, a company selects the strategy judged as the most suitable to its size, capability, product maturity, business expectations, etc. To understand the subjective approach to adopt an efficient company strategy, I will use the example of my personal experience.

The involved company is a relatively small company within a much bigger corporation with a rich experience in military applications. In addition, 20 years ago the company entered the space domain, as the national prime contractor for domestic satellites. I had the privilege to lead all the EEE components activities, found necessary to build, activate, and manage the applicable infrastructure.

At the start, we voluntarily adopted the ESA approach, using only space/military grade EEE components across the board (LEO and GEO satellites).

Following global developments (components manufacturers leave of military market, Perry's directive, shrinking military components market) we realized that we have to change the strategy, first for military and after some years of good experience for space.

For LEO satellites, the EEE component selection priority has been reversed across the board, upside down:

- First priority: COTS/PEMs

- Second priority: Military-grade EEE components

- Third priority: Space-grade EEE components

Why were GEO satellites exempted? Following are the main considerations.

Availability of needed subsystems

For GEO communication satellites, we have to use more intensive foreign outsourcing. Looking for subsystems in the foreign space industry, one faces a reality of exclusive practice of traditional space methodology. Consequently, the offers are as such.

GEO mission duration (15 years)

Compared to LEO applications the higher mission duration of GEO communication satellites results in higher radiation requirements, reducing the ability to find proper COTS candidates.

- Risk Assessment

Compared to LEO satellites, the GEO communication satellites are much larger, more costly, less technologically sophisticated.

The insurance companies also follow the traditional approach.

The switch to intensive use of COTS, in our case, has not been driven mainly by cost considerations. It has been clear from the beginning that applying the traditional testing/screening approach to COTS will result in higher ownership cost. Nevertheless, the availability security was and is a prime concern.

Another aspect of the procurement strategy is outsourcing. The maturity in the space domain and the will not to carry the heavy burden of space oriented EEE components procurement, leads a company to decide what to outsource.

From the start, we have decided to outsource space EEE components to a central parts procurement agency (CPPA).

At our not conventional move to COTS/PEMs (for space) timing, no CPPA could be found to accept our revolutionary approach. Fortunately we succeeded to convince a CPPA to cooperate, giving logistic, testing, and engineering service as per our original approach.

The move to use of COTS in space further emphasized the need for a centralized EEE components engineering and procurement approach to reduce the NRE cost.

The 100 percent in orbit success proved the rightness of our daring decisions. Unfortunately, the official space EEE Components approach is still debated. The availability security of space/military EEE components is far from being assured.

EEE components procurement methods for space applications

A space prime contractor, as well as a space Subcontractor, has to adopt a procurement method to fit its needs.

As a prime contractor (system design and subsystems design/manufacturing), we worked within LEO projects with many domestic subcontractors, entering the space domain through our projects. Consequently, the lack of knowledge and experience has put an additional burden on our component engineering, being a consideration in selecting an adequate procurement method.

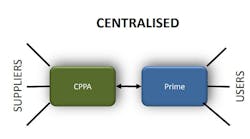

Deciding to outsource the space EEE components to a CPPA, we were advised that more or less two options are available for our needs.

The Centralized Procurement Method, consisting of the following main elements:

The prime contractor performs the flight EEE components procurement for all the subsystems' subcontractors, from the CPPA and deliver the relevant ones to the subcontractors. The CPPA performs the applicable procurement from the components manufacturers, performs the post procurement engineering/testing activities and deliver the flight components to the prime contractor. Everything is done in accordance to the applicable Prime Contractor's requirements, under the prime contractor responsibility.

There are two main disadvantages for this method:

- The procurement timings for the participating parties have to be synchronized in order not to cause delays for everybody.

- The development maturity at different subcontractors may not reach the same level at the assigned last date for flight procurement.

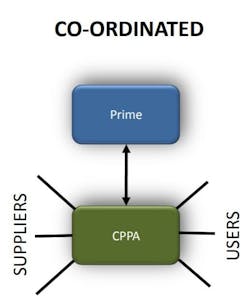

The Coordinated Procurement Method, consisting of the following main elements:

Everything is done in accordance with the applicable prime contractor's requirements, within a prime contractor/CPPA frame contract.

Each participating subsystem's subcontractor procures the flight EEE components from the CPPA. The CPPA performs the applicable procurement from the components manufacturers, performs the post procurement engineering/testing activities and deliver the flight components to the subcontractor.

Disadvantages:

- There is less prime contractor visibility

- More NRE at Project level

- Less opportunities for orders' consolidation (at CPPA)

As already mentioned the above procurement methods worked well for space, military, and COTS.

More mature and more experienced foreign subcontractors deal independently with the procurement of the flight components meeting the prime contractor project requirements.

Procurement requirements

The main procurement requirements are, not limited to:

- Procure only directly from the approved component manufacturer or from his franchised agents/distributors.

- Procure only the approved part number (not replacements).

- Component Manufacturer's Certificate of Conformance is required.

- Component Age limit applies.

- One Lot shipment is required.

- Relevant packing method is required.

Procurement threats

As dealt separately, the main threats to pay attention to are:

- Counterfeit.

- Obsolescence.

Conclusion

- The EEE components procurement process is a multi-disciplined one.

- The procurement process is a three-tier process: pre-procurement, procurement, post-procurement.

- The process includes component engineering, test engineering, electrical/environmental testing, radiation testing, specification writing.

- The process shall be managed logistically, as well as technically, in accordance with the approved strategy and method.

- Use of COTS complicates the already complex process, requiring deep specialized knowledge.

The author, Dan Friedlander, graduated Engineering School/Tel Aviv University with a degree in physics (1965-1969). He has 44 years of experience in Component Engineering at MBT/Israeli Aerospace Industries (1969 to 2013), as Head of Components Engineering. As such, he was responsible for all aspects of EEE components – including policymaking, standardization at corporate level, approval, etc. – for military and space applications. Now retired, Friedlander is an industry consultancy (2013 to present). For further details on his experience, visit https://www.linkedin.com/in/dan-friedlander-63620092?trk=nav_responsive_tab_profile

The go-to resource for Intelligent Aerospace technology news & information:

Covering key topics

Across all market segments

Subscribe to the free Intelligent Inbox e-newsletter: http://www.intelligent-aerospace.com/subscribe.html.

Connect on social media:

Keep pace with aerospace innovation and opportunities via your favorite social media channels. Connect with Intelligent Aerospace on Twitter (@IntelligentAero), LinkedIn,Google+, and Instagram.