RF MEMS switches deliver on early promise

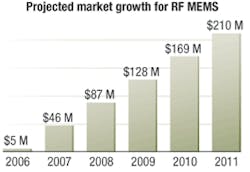

The market for radio-frequency micro electromechanical systems (RF MEMS) devices will grow quickly to $210 million in 2011, up from $5 million in 2006, predict analysts at WTC Wicht Technologie Consulting (WTC) in Munich, Germany.

More than $100 million of this market is destined for test and instrumentation like automated test equipment used in the semiconductor industry, followed by devices for mobile phones and telecommunications infrastructure, WTC analysts say.

At the module level, reconfigurable power amplifiers and antenna modules for cell phones should exceed $150 million in 2011.

“We have been following developments in RF MEMS switches since 2000, when the mobile phone market was booming and a number of companies envisioned using RF MEMS switches in each handset,” says Jérémie Bouchaud, head of market research at WTC.

“What happened after perfectly fits the well-known hype curve of new technologies,” Bouchaud explains. “After experiencing the so-called peak of inflated expectations in 2003 and a subsequent trough of disillusionment phase during 2004 to 2005, RF MEMS switches have now emerged shining into the slope of enlightenment, an indicator that both the industry and technology are maturing.”

Recent announcements from NXP and RFMD underscore this point; both companies are preparing to mass produce antenna matching and reconfigurable power amplifiers for cell phones, respectively, WTC says.

As of November 2007, WTC estimates that around 50,000 switches are shipped monthly and that 500,000 to 600,000 switches have already left the fabs (not including automated distribution frames DC switches produced for the qualification phase).

A handful of companies have started selling RF MEMS switches, among them Teravicta, Radant (due to export restrictions in the US only for the moment), Advantest, and Matsushita.

Companies sampling switches for selected customers include WiSpry for mobile handsets and MEMTronics and XCOM for high-end applications such as defense. Omron recently joined the pack and is expected to start serial production by mid-2008.

Meanwhile NXP is currently in the industrialization phase of switched capacitors for cell phones and is focusing its efforts on process and manufacturability. Meanwhile foundries like IMT and APM have launched serial production of DC switches for automated distribution frames for telecommunications.

Potential applications for RF MEMS switches include aerospace and defense, test and instrumentation, and telecommunications.

RF MEMS switches are making their way into the semiconductor industry. Such switches will influence telecom infrastructure markets from 2008 in automated distribution frames. The first defense deployments should emerge around 2009.

Regarding cell phones, WTC analysts say they believe that impedance matching networks for the power amplifier or antenna module offer the best (and only) prospects for RF MEMS switches-or more precisely, switched capacitors-in the next five years.

NXP, RFMD, and WiSpry are developing switches for this function. RFMD just announced an 8-inch fab for RF MEMS PA module switches, while NXP plans to commercialize antenna-matching circuits based on switched capacitors as early as 2009 or 2010.

WTC has also investigated automotive applications such as radar or roof antennas. The company does not see an opportunity for RF MEMS switches in the automotive sector by 2012, contrary to the statements made in other market reports.

For more information, visit WTC online at www.wtc-consult.de/briefings.